Money Laundering Country Risk Index

Whilst there is a tremendous amount of information about money laundering, organized crime and terrorism, it is obviously very difficult to produce definitive statistics as to the true scale of the problem. However, what becomes clear both when this section was compiled and, hopefully, when you read it is that very few countries or geographical regions remain untouched by the problem. What also becomes noticeable is that although offshore financial centres obviously provide loopholes for launderers to exploit there still exist many onshore and more mainstream locations that can be, and are being, used for the washing of criminally obtained funds.

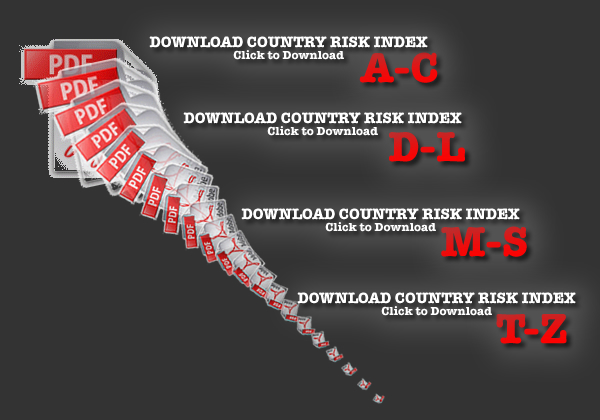

The purpose of this section is not merely to prove the universal and corrosive influence and infiltration of criminal activity but more importantly to provide information on countries:

The moral of the story is not however to adopt a Howard Hughes stance and become a recluse, not doing business with anybody from anywhere; rather forewarned is forearmed – by being cognizant of the risks that you run you should be able to manage, control and mitigate them. All of the information here, whilst country specific, is of a generalized nature: to control your money laundering risks you need to carry out specific and focused background research/due diligence enquiries on the individual(s) and/or companies you are contemplating getting into bed with.

In compiling this section attention has been paid to the various interlinked factors that can give rise to money laundering problems. These include:

Also highlighted are countries where information is hard to come by and countries where there are no significant money laundering problems. Additionally, at the end of this appendix are complete listings, together with analysis, of the blacklists of non-cooperative countries and territories issued by the FATF since June 2000.

The risks outlined regarding money laundering in major financial centres are, by their very nature, something of a tautology – it is almost impossible to have a domestic or regional financial centre without the scourge of money laundering being present. Equally evident is the fact that the most attractive centres for money launderers to aim for, usually in the integration stage of the process, are the major respected financial centres of the world.

|

|